📘 Introduction

Access to timely financing is essential for business survival and growth. Whether you are running a startup, small enterprise, or established company, understanding your business loan eligibility before applying can save time and prevent rejection. Many business owners approach lenders without clarity on eligibility criteria, which often leads to disappointment and credit score impact.

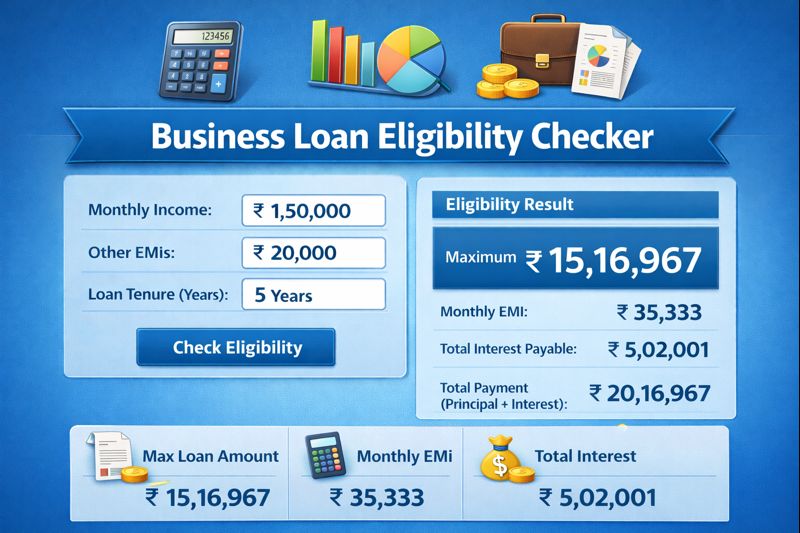

The Business Loan Eligibility Checker is designed to give entrepreneurs a clear and realistic estimate of how much loan they may qualify for. By using standard banking and NBFC evaluation parameters, this tool helps businesses prepare better, choose suitable lenders, and plan financial growth with confidence.

🏦 Business Loan Eligibility Checker (Tool)

Instantly estimate your business loan eligibility using basic financial inputs.

Table of Contents

- Introduction

- Tool :- Business Loan Eligibility Checker

- Quick Summary / Key Takeaways

- What Is This Tool?

- Who This Tool Is For (Persona & ICP)

- Core Pain Points This Tool Solves

- How This Guide Solves Those Pain Points

- Why Use This Tool

- When to Use This Tool

- How to Use This Tool (Step-by-Step)

- Benefits of Using This Tool

- Privacy, Security & Trust Signals

- FAQ

- Also Known As

⚡ Quick Summary / Key Takeaways

The Business Loan Eligibility Checker gives instant insights into your borrowing capacity based on income, credit profile, and business stability.

It is a free, easy-to-use tool that helps businesses approach lenders with realistic expectations.

Key Takeaways

- Instant eligibility check

- Free online tool

- No signup required

- Accurate estimation

- Suitable for SMEs and MSMEs

📖 What Is This Tool?

The Business Loan Eligibility Checker is an online financial assessment tool that estimates the maximum loan amount a business may qualify for from banks or financial institutions.

It uses commonly accepted eligibility criteria such as business income, credit score, existing liabilities, and loan tenure to deliver realistic eligibility results.

Tool Definition

- Online eligibility assessment

- Lender-inspired calculation logic

- Instant results

- Beginner-friendly interface

- Reliable estimates

🎯 Who This Tool Is For (Persona & ICP)

This tool is ideal for entrepreneurs and business owners who are planning to apply for a business loan or expand operations using external financing.

It is also useful for financial advisors and consultants who assist clients with business funding decisions.

Ideal Users & Customer Profiles

- Small business owners

- Startup founders

- MSME operators

- Self-employed professionals

- Financial consultants

😖 Core Pain Points This Tool Solves

Many businesses struggle with unclear eligibility rules, leading to repeated loan rejections and wasted effort.

Lack of clarity around income assessment, credit score impact, and loan limits creates confusion and financial stress.

Problems Users Face

- Unclear eligibility criteria

- Unexpected loan rejection

- Credit score damage

- Time-consuming applications

- Unrealistic loan expectations

- Financial uncertainty

- Lack of guidance

✅ How This Guide Solves Those Pain Points

The Business Loan Eligibility Checker provides transparent calculations that help businesses understand their borrowing capacity clearly.

By offering instant insights, it enables better preparation and smarter lender selection.

How This Content Helps

- Clarifies eligibility rules

- Sets realistic expectations

- Reduces rejection risk

- Saves time

- Improves planning

- Builds confidence

- Enhances decision-making

💡 Why Use This Tool

This tool empowers businesses to approach lenders with confidence and clarity.

It simplifies financial planning by providing fast and accurate eligibility insights.

Value Proposition

- Fast eligibility check

- Accurate estimation

- Simple to use

- Free access

- Trusted financial logic

⏰ When to Use This Tool

This tool is best used before applying for a business loan to avoid unnecessary rejections.

It is also useful when comparing loan options or planning business expansion.

Best Use Scenarios

- Before loan application

- Business expansion planning

- Working capital assessment

- Credit improvement planning

- Lender comparison

🛠️ How to Use This Tool (Step-by-Step)

The Business Loan Eligibility Checker is designed for simplicity and speed.

Just enter your business details to get instant eligibility results.

Usage Steps

- Enter business income

- Enter credit score

- Select loan tenure

- Click check eligibility

- View estimated loan amount

🏆 Benefits of Using This Tool

Using this tool improves financial readiness and helps businesses make informed borrowing decisions.

It ensures better alignment between loan expectations and lender requirements.

Key Advantages

- Instant eligibility results

- Accurate calculations

- No registration needed

- Time-saving

- Improved planning

- Reduced rejection risk

- Better lender targeting

- User-friendly interface

- Free to use

- Reliable insights

🔒 Privacy, Security & Trust Signals

User privacy is a top priority for this tool.

No personal or business data is stored or shared.

All calculations happen securely in real time.

Your Data Safety

- No data storage

- No tracking

- Secure processing

- Privacy-first design

- Trusted platform

- Safe to use

Also Known As

Alternative names and related terms for this tool.

FAQs

What is a business loan eligibility checker?

It estimates how much business loan you may qualify for.

Is this tool free to use?

Yes, it is completely free.

Does it guarantee loan approval?

No, it provides estimates, not guarantees.

Is my data stored?

No, no data is stored.

Do startups qualify?

Yes, startups can use it.

Does credit score matter?

Yes, credit score impacts eligibility.

Can MSMEs use this tool?

Yes, it is suitable for MSMEs.

Is registration required?

No registration is required.

How accurate are the results?

They are based on standard lender criteria.

Does income affect eligibility?

Yes, business income is a key factor.

Is the tool secure?

Yes, it follows privacy-first principles.

Can I compare lenders?

Yes, it helps shortlist suitable lenders.

Does tenure affect eligibility?

Yes, loan tenure influences eligibility.

Can consultants use it?

Yes, consultants can use it for clients.

Is it mobile-friendly?

Yes, it works on all devices.

Does turnover matter?

Yes, turnover impacts eligibility.

Is it fast?

Yes, results are instant.

Can I use it multiple times?

Yes, unlimited usage.

Does it support all banks?

It uses general banking criteria.

Who should use this tool?

Any business planning to apply for a loan.

🔧 Other Finance And Business Tools

🗂️ Tool Categories

No categories available