📘 Introduction

Working capital is a critical financial metric that reflects a company’s short-term financial health and operational efficiency. It represents the difference between current assets and current liabilities and indicates whether a business can meet its short-term obligations. Positive working capital means a company has enough liquid assets to cover its immediate expenses, while negative working capital may signal cash flow challenges.

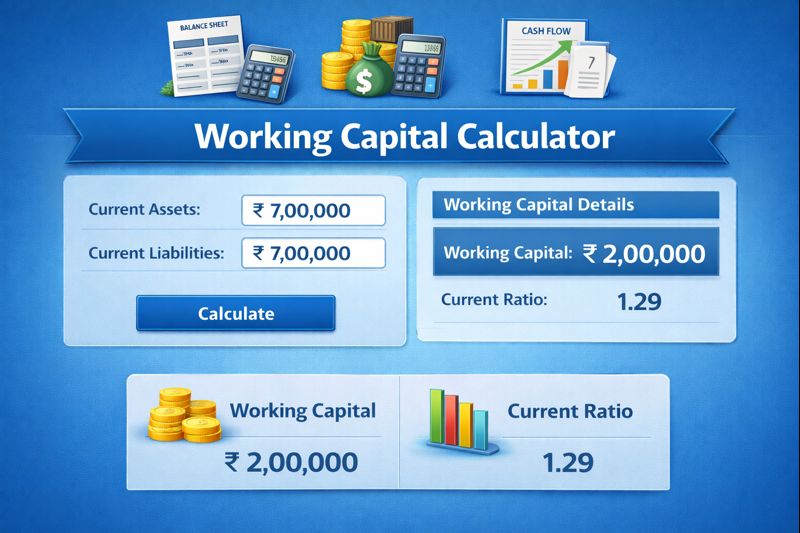

The Working Capital Calculator helps business owners, finance managers, and entrepreneurs quickly calculate net working capital without complex spreadsheets. By entering current assets and current liabilities, users can instantly assess liquidity, plan operations, and make informed financial decisions that support sustainable growth.

💼 Working Capital Calculator (Tool)

Calculate your business working capital to understand short-term liquidity health.

Table of Contents

- Introduction

- Tool :- Working Capital Calculator

- Quick Summary / Key Takeaways

- What Is This Tool?

- Who This Tool Is For (Persona & ICP)

- Core Pain Points This Tool Solves

- How This Guide Solves Those Pain Points

- Why Use This Tool

- When to Use This Tool

- How to Use This Tool (Step-by-Step)

- Benefits of Using This Tool

- Privacy, Security & Trust Signals

- FAQ

- Also Known As

⚡ Quick Summary / Key Takeaways

The Working Capital Calculator gives instant insights into your business liquidity by calculating net working capital accurately.

It is a simple and free tool designed for businesses of all sizes, including startups, SMEs, and large enterprises.

Key Takeaways

- Instant working capital calculation

- Uses standard financial formula

- Free and easy to use

- No registration required

- Ideal for business planning

📖 What Is This Tool?

The Working Capital Calculator is an online financial tool that calculates net working capital using the formula: Current Assets minus Current Liabilities.

It helps businesses quickly understand their liquidity position and assess whether they have sufficient resources to fund short-term operations.

Tool Definition

- Online working capital calculator

- Uses standard accounting formula

- Instant results

- User-friendly interface

- Accurate financial insights

🎯 Who This Tool Is For (Persona & ICP)

This tool is designed for business owners, finance managers, and entrepreneurs who want to monitor liquidity and manage cash flow effectively.

It is also useful for accountants, consultants, and students learning financial fundamentals.

Ideal Users & Customer Profiles

- Small business owners

- Startup founders

- Finance managers

- Accountants

- Business consultants

😖 Core Pain Points This Tool Solves

Many businesses struggle to understand their liquidity position due to complex financial statements.

Lack of clarity around working capital often leads to cash shortages and poor operational decisions.

Problems Users Face

- Unclear liquidity position

- Cash flow mismanagement

- Complex calculations

- Time-consuming spreadsheets

- Poor financial visibility

- Operational inefficiencies

- Planning difficulties

✅ How This Guide Solves Those Pain Points

The Working Capital Calculator simplifies liquidity analysis by providing instant and accurate calculations.

It eliminates manual errors and helps businesses make faster, data-driven decisions.

How This Content Helps

- Simplifies calculations

- Improves accuracy

- Saves time

- Enhances planning

- Improves cash flow control

- Builds confidence

- Supports growth

💡 Why Use This Tool

This tool provides a clear snapshot of your business liquidity in seconds.

It supports smarter financial decisions and operational stability.

Value Proposition

- Fast results

- Accurate calculations

- Easy to use

- Free access

- Trusted financial logic

⏰ When to Use This Tool

This tool should be used regularly to monitor business liquidity.

It is especially useful before major financial decisions or funding applications.

Best Use Scenarios

- Monthly financial review

- Cash flow planning

- Loan applications

- Business expansion planning

- Budgeting decisions

🛠️ How to Use This Tool (Step-by-Step)

The Working Capital Calculator is designed for simplicity and speed.

Just enter your financial values to get instant results.

Usage Steps

- Enter current assets

- Enter current liabilities

- Click calculate

- View net working capital

- Interpret liquidity position

🏆 Benefits of Using This Tool

Using this tool improves financial awareness and operational efficiency.

It helps businesses maintain healthy cash flow and stability.

Key Advantages

- Instant liquidity insights

- Accurate calculations

- Easy to use

- No registration required

- Time-saving

- Better cash management

- Improved planning

- Reduced financial risk

- Free access

- Business-friendly

🔒 Privacy, Security & Trust Signals

Your financial data is never stored or shared.

All calculations are performed securely and instantly.

Privacy and trust are built into the tool design.

Your Data Safety

- No data storage

- No tracking

- Secure processing

- Privacy-first design

- Trusted platform

- Safe to use

Also Known As

Alternative terms and related keywords for this tool.

FAQs

What is working capital?

Working capital is the difference between current assets and current liabilities.

What is net working capital?

Net working capital equals current assets minus current liabilities.

Is this tool free?

Yes, it is completely free to use.

Is registration required?

No registration is required.

Is my data stored?

No, no financial data is stored.

Who should use this calculator?

Business owners, finance managers, and students.

Is it accurate?

Yes, it uses standard accounting formulas.

Can startups use it?

Yes, startups can use it.

Does it work for SMEs?

Yes, it is ideal for SMEs.

What are current assets?

Assets expected to be converted into cash within one year.

What are current liabilities?

Short-term financial obligations due within one year.

Can I use it for loan planning?

Yes, it helps assess liquidity for loans.

Is it mobile-friendly?

Yes, it works on all devices.

Does it support multiple currencies?

Yes, values can be entered in any currency.

How often should I calculate working capital?

Regularly, such as monthly or quarterly.

Does positive working capital mean good health?

Generally yes, but context matters.

Can negative working capital be bad?

It may indicate liquidity issues.

Is this tool secure?

Yes, it follows privacy-first principles.

Does it replace an accountant?

No, it supports but does not replace professional advice.

Can students use this tool?

Yes, it is useful for learning finance basics.

🔧 Other Finance And Business Tools

🗂️ Tool Categories

No categories available